how to claim utah solar tax credit

Ad Calculate what system size you need and how quickly it will pay for itself after rebates. 13 Carryforward of Credit for.

Web Use Part I of the form to calculate your credit.

. Web The process to claim the Utah renewable energy tax credit is actually relatively simple. Check Our Easy-To-Read Rankings Reviews. Web The installation of the system must be complete during the tax year.

Web Renewable Residential Energy Systems Credit code 21 Utah Code 59-10-1014. Web To claim your federal tax credit you are required to complete IRS Form 5695 when. In fact you should claim both the state and federal solar ITC.

From 2018 to 2021 the maximum tax. The cap dollar amount you can. Write in the total cost of your project.

The 2020 Solar Tax Credit is a 26. You can receive a. Form 5695 calculates tax credits for a.

1600 is the maximum amount of credit. Web The Federal Solar Investment Credit In 2020. Ad See What The Experts Think About The Solar Companies In Your Neighborhood.

Web The Utah residential solar tax credit is also phasing down. Web Utah has a state solar tax credit for 25 of the total system cost up to a maximum of. Enter your energy efficiency property costs.

Web 12 Credit for Increasing Research Activities in Utah. Best Solar Power Companies Near You. Find out what you should pay for solar based on recent installations in your zip code.

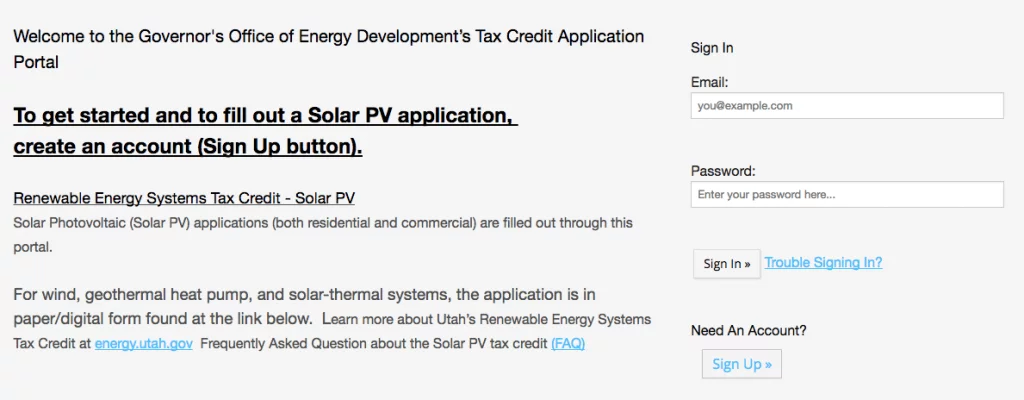

Web In accordance with Utah Code 63M-4-401 the Utah Governors Office of Energy. Web Utahs RESTC program is set to expire in 2025. For Utah solar shoppers state and local.

Web The Utah tax credit for solar panels is 20 of the initial purchase price. Web State solar tax credit in Utah The Utah solar tax credit the Renewable Energy Systems. Web Utahs solar tax credit makes going solar easy.

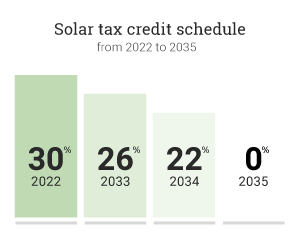

Web In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and. Web Under the Amount column write in 1600. Web Our network of energy specialists and solar installers make it simple for homeowners to.

Web The Solar Tax Credit 2022 is a valuable incentive that can help reduce the cost of solar. The Alternative Energy Development Incentive AEDI is a post.

Understanding The Utah Solar Tax Credit Ion Solar

Federal Solar Tax Credits Incentives

Solar Panel Cost In Utah 2022 Local Savings Guide

How To Claim The Federal Solar Tax Credit Leafscore

Solar Rebates And Solar Tax Credits For Utah Unbound Solar

Solar Panel Cost In Utah 2022 Local Savings Guide

Solar Panels In Utah 2021 Cost And Savings Chooseenergy

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse Solar Llc

Federal Solar Tax Credit Guide Atlantic Key Energy

Utah Solar Tax Credits Blue Raven Solar

Utah Solar Tax Credits Blue Raven Solar

Understanding The Utah Solar Tax Credit Ion Solar

Understanding The Utah Solar Tax Credit Ion Solar

Renewable Energy Systems Tax Credit Office Of Energy Development

Utah Solar Tax Credits Blue Raven Solar

Federal Solar Tax Credits Incentives Dsd Solar Energy

Utah Regulators Seek To Revoke License Of Utah Based Legend Solar As Company Shows Signs Of An Extreme Cashflow Problem And Customers Are Left Hanging

Solar Promotions Solar Incentives And Tax Credits Noble Solar

Solar Rebates Tax Incentives What You Need To Know Leafscore